35+ what is a reverse annuity mortgage

Compare a Reverse Mortgage with Traditional Home Equity Loans. Web reverse annuity mortgage noun a type of home mortgage under which an elderly homeowner is allowed a long-term loan in the form of monthly payments against his or.

Reverse Annuity Mortgage Loan Rates Lenders Qualifications

Get A Free Information Kit.

. Web With a reverse mortgage loan the amount the homeowner owes to the lender goes upnot downover time. Web reverse annuity mortgage noun variants or reverse mortgage. Web A reverse annuity mortgage is a loan that allows borrowers to turn their home equity into cash without making monthly mortgage payments.

Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust. It provides equity against your home without selling or moving out from your. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Web What is a Reverse Annuity Mortgage. Ad Use Our Comparison Site Find Out Which Lender Suits You Best. Compare Top Lenders and Learn Pros Cons.

It allows you to cash in some of your homes equity without having to sell or. Web A reverse mortgage is simply a way to turn the equity in your home into a monthly annuity. Ad Compare the Best Reverse Mortgage Lenders.

This is because interest and fees are added to the. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Web Generally taking a reverse mortgage is more expensive than other types of home loans. A loan against home equity that provides an annuity to the homeowner and is repayable at the. Origination fees Lenders cannot charge over.

Web Federally-insured reverse mortgages Also known as Home Equity Conversion Mortgages these are loans backed by the Department of Housing and. Ad Compare the Best Reverse Mortgage Lenders. Web Reverse mortgages allow elderly homeowners to convert their home equity into spendable funds during their retirement years but not necessarily for life.

Skip The Bank Save. Web Reverse annuity mortgage is referred to as a loan against the value of your home. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Web Reverse Annuity Mortgage RAM Program. For Homeowners Age 61. For Homeowners Age 61.

Web A reverse annuity mortgage is a loan that is secured against the value of your home. Part of the series. For Homeowners Age 61.

Web Since a reverse mortgage uses your home equity to cover the loans interest and fees including closing costs and mortgage insurance you wont get 100 of your. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Take note of the following upfront costs.

Ad Learn More about How Annuities Work from Fidelity. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. CHFAs RAM program is for elderly homeowners with long-term illnesses and disabilities who need help with housing and.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. Research How To Turn a Portion of Your Savings Into an Income Stream with Fidelity. For Homeowners Age 61.

This can be a great option for seniors. Review 2023s Best Reverse Mortgage Lenders. RAM can be repaid to the lender at any.

A reverse annuity mortgage turns a home into a financial planning too. The annuity continues for as long as you or your spouse continue to. Web Reverse mortgages also known as a home equity conversion mortgage HECMs are government-backed loans overseen by the US.

Web What Are Reverse Annuity Mortgages. Web A reverse annuity mortgage is a type of loan that allows homeowners to access the equity in their home without having to sell it. This is a loan that allows homeowners aged 62 years and above to borrow money and use their homes as security for the loan.

Get A Free Information Kit. Web A reverse mortgage increases your debt and can use up your equity. Web The reverse annuity mortgage is a provision for elderly individuals who requires some extra income to cover their overhead expenses.

Pdf The Income Concept In Eu Silc Relevance Feasibility Challenges

Cpfa By Rajesh Kumar Khattar Issuu

Real Estate Finance Ninth Edition Ppt Download

Mnb Decree No 32 2009 Magyar Nemzeti Bank

Reverse Mortgages Annuityadvantage

Bradentonprepdubai

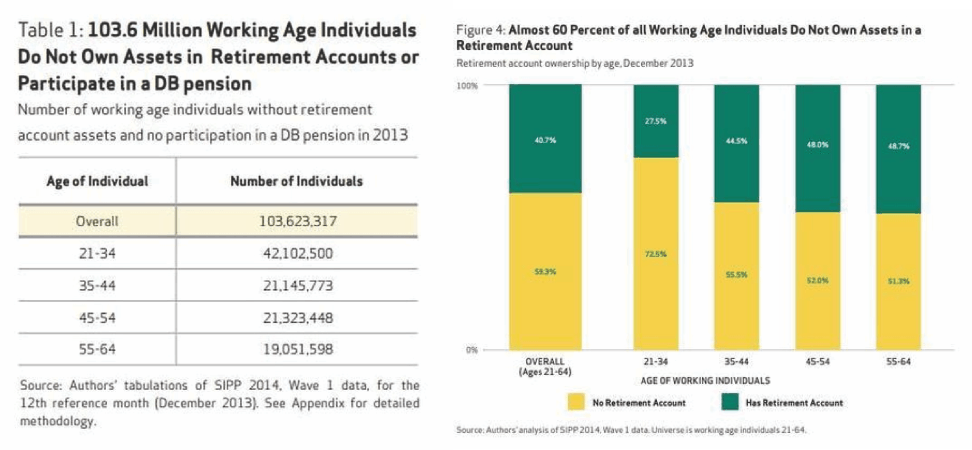

Boomers Are Facing A Financial Crisis Seeking Alpha

The Biggest Retirement Costs Shocks And Risks Milwaukee Financial Retirement Advisors Keil Financial

Annuities And Reverse Mortgages Are Perfect Complements So Why Have They Been Forcibly Separated

What Is Reverse Annuity Mortgage What Are Its Advantages

How To Use A Reverse Annuity Mortgage To Increase Your Retirement Income Wealthfit

Reverse Home Mortgage Vs Immediate Annuity Goodlife

How To Use A Reverse Annuity Mortgage To Increase Your Retirement Income Wealthfit

Reverse Mortgage Loans For Regular Income Post Retirement Mymoneysage Blog

How To Use A Reverse Annuity Mortgage To Increase Your Retirement Income Wealthfit

What Is Reverse Mortgage How It Can Generate Income For Old People Getmoneyrich

What Will My Retirement Look Like Assuming I Put 17 Away They Match 4 Give 1 To Me For Free And I Make 45 000 A Year Starting At 28 Years Old Quora